I recently attended a Cisco Collaboration analyst day in the U.K. and was impressed by what I heard and saw. Cisco of course is known as a supplier of network equipment and software, and it has long provided these through a global network of partners. But Cisco also has been in the contact center market for several years and has had success with its small and enterprise contact center systems, having more than 20,000 on-premises customers and revenue in excess of US $1.5 billion. Cisco markets the contact center systems as Customer Collaboration , but the portfolio is still based on its two longstanding contact center products: Unified Contact Center Enterprise and Unified Contact Center Express , designed for larger and smaller centers, respectively. Two other options are CiscoPackaged Contact Center Enterprise and Cisco Hosted Collaboration Solution for Contact Center (HCS-CC) . These both use the Enterprise products, but the first comes packaged and so has less options, and the second is based on cloud computing; both are easier to deploy and more affordable for a wider market than the other options.

Cisco’s strategy seems clear – to keep the product portfolio as is but to add capabilities (whether through internal development, acquisitions or strategic partnerships such as eGain), to continue to support customers through its highly evolved network of global partners and to add additional supply options. Developments are driven by a four-point action plan – improve the user experience, offer high-quality product development and support services, technically support “omnichannel” customer engagement and provide more cloud-based services. Cisco has been working on the user interface and integration of its products to bring them more in line with users’ expectations. The latest versions are much improved, but I think Cisco has more to do to develop a task-oriented user interface that has point-and-click capabilities for tasks, not applications; this is much like younger users expect when using smartphones or tablets. Cisco has also been working on its development and delivery processes to improve product quality and customer satisfaction.

From my perspective the biggest changes relate to supporting multiple channels of communication and making the applications accessible to a wider set of employees. Our benchmark research into next-generation customer engagement confirms what most people have come to realize: Consumers use multiple channels to engage with companies, and companies must support those channels.

The research finds that companies now support on average seven or eight channels, and Cisco’s products now support six: telephone, email, Web, chat, social video and mobile. The analyst day showed a focus on video, and the presenters demonstrated innovative use of video to provide customer support, which although it is still in the early days of adoption (29% of companies currently support video), I expect this percentage to climb, partly as more consumers use Skype video calls for personal conversations and customer service. There also were demonstrations of innovative support for kiosks as a communication channel, including video. These, and mobility in particular, demonstrated more choice and improved experiences for customers. A key factor is that Cisco’s products are based on the same platform and so helps users provide their own customers with omnichannel experiences across the supported channels.

The research finds that companies now support on average seven or eight channels, and Cisco’s products now support six: telephone, email, Web, chat, social video and mobile. The analyst day showed a focus on video, and the presenters demonstrated innovative use of video to provide customer support, which although it is still in the early days of adoption (29% of companies currently support video), I expect this percentage to climb, partly as more consumers use Skype video calls for personal conversations and customer service. There also were demonstrations of innovative support for kiosks as a communication channel, including video. These, and mobility in particular, demonstrated more choice and improved experiences for customers. A key factor is that Cisco’s products are based on the same platform and so helps users provide their own customers with omnichannel experiences across the supported channels.

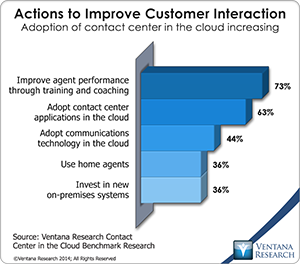

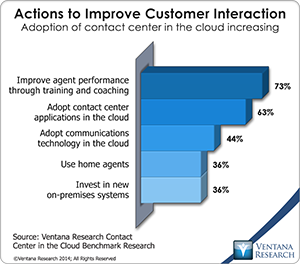

Cisco’s other significant move is support for the cloud. Our benchmark research into the contact center in the cloud finds that to improve the handling of customer interactions, companies plan to adopt applications and communication channel management in the cloud, and from discussion forums I have participated in, more companies are now adopting cloud-based systems to improve interaction handling.

Cisco Hosted Collaboration Solution for Contact Center is a version of Contact Center Enterprise packaged with the Cisco Unified Customer Voice Portal – Cisco’s version of IVR – and available through cloud computing. It provides services for companies wanting a large variety of capabilities and is scalable up to 12,000 seats. The services are available directly from Cisco through a public cloud or through Cisco-approved partners using their own cloud services. This option gives potential customers a wider choice but does create possible confusion as Cisco’s direct sales people are also compensated for selling partner services. Nevertheless it demonstrates the overall market disposition to use cloud services; its 19 approved partners delivered year-on-year growth of 182 percent during 2014, and 25 percent of Cisco’s contact center business now comes from cloud services. During a presentation one of its partners, KCom , stated that more of its customers are looking to the cloud rather than on-premises, a trend I expect to increase across the market.

Cisco Hosted Collaboration Solution for Contact Center is a version of Contact Center Enterprise packaged with the Cisco Unified Customer Voice Portal – Cisco’s version of IVR – and available through cloud computing. It provides services for companies wanting a large variety of capabilities and is scalable up to 12,000 seats. The services are available directly from Cisco through a public cloud or through Cisco-approved partners using their own cloud services. This option gives potential customers a wider choice but does create possible confusion as Cisco’s direct sales people are also compensated for selling partner services. Nevertheless it demonstrates the overall market disposition to use cloud services; its 19 approved partners delivered year-on-year growth of 182 percent during 2014, and 25 percent of Cisco’s contact center business now comes from cloud services. During a presentation one of its partners, KCom , stated that more of its customers are looking to the cloud rather than on-premises, a trend I expect to increase across the market.

The two primary Cisco contact center products, Enterprise and Express, offer too wide range of capabilities to cover fully in this perspective, so if you are interested please use the links above for more information. The key differences from my perspective are these:

Express is a targeted at smaller centers and is an all-in-one product that is easy to deploy and use. Enterprise targets larger centers, is more customizable and scalable, and supports more distributed centers.

Express supports voice, video, chat, email, IVR and social media, and it comes with a set of APIs to common third-party products and a reporting package. It also offers options including quality monitoring and workforce management, which interestingly are not available with Enterprise.

Enterprise supports a similar number of channels but also outbound call management. It includes the Cisco collaboration platform that allows employees across the enterprise to collaborate on customer-related tasks. Enterprise also comes in a packaged version that is designed to include all the capabilities but is not as scalable.

Both include Cisco Finesse, which is what we call a smart agent desktop. This is used by customers and/or partners such as UpstreamWorks to create highly capable and flexible desktop systems; this is achieved by embedding customizable widgets inside a common “container”; the widgets make it easier for users to access systems and information. During the analyst day one of Cisco’s customers, Booking.com , demonstrated the desktop system it has created, which is the most innovative agent desktop I have come across in more than 25 years in the contact center market.

Enterprise includes something Cisco calls precision routing. This turns routing of interactions on its head so instead of routing based on agents’ skills, it routes interactions based on the customer’s needs and the employee best placed to meet those needs. The system brings together information about the customers and the topic of the interaction and searches for the employee, who could reside outside the contact center, most likely to achieve the best outcome, thus potentially improving the customer experience and satisfaction. This can, for example, be used in conjunction with a mobile app so if the customer cannot complete the interaction, he or she can be routed to the best “agent” along with all the information collected in the app so the customer doesn’t have to start afresh.

Despite having these impressive capabilities, Cisco doesn’t make it easy for prospective customers to find information about its contact center products. If you click on the product tab on its home page, you don’t immediately see any contact center products. You need to drill down one level, using the customer collaboration link to find the contact center systems. And the marketing of the products is not very insightful or collaborative. I think “customer collaboration” is a misnomer as I associate customer collaboration with shared Web pages, chat sessions or social media forums in which contact center agents collaborate with customers to resolve issues. The Cisco products go beyond that and, as I have said, support multichannel management, a smart desktop, knowledge management and in some cases workforce optimization and analytics – indeed it covers many of the systems I predict will have the biggest impact on the customer experience during 2015 . I therefore recommend that organizations seeking to improve the customer experience assess how Cisco can support those efforts but will require a little extra work to actually get the information required to determine if they should be on the vendor evaluation short list.

Regards,

Richard J. Snow

VP & Research Director

The research finds that companies now support on average seven or eight channels, and Cisco’s products now support six: telephone, email, Web, chat, social video and mobile. The analyst day showed a focus on video, and the presenters demonstrated innovative use of video to provide customer support, which although it is still in the early days of adoption (29% of companies currently support video), I expect this percentage to climb, partly as more consumers use Skype video calls for personal conversations and customer service. There also were demonstrations of innovative support for kiosks as a communication channel, including video. These, and mobility in particular, demonstrated more choice and improved experiences for customers. A key factor is that Cisco’s products are based on the same platform and so helps users provide their own customers with omnichannel experiences across the supported channels.

The research finds that companies now support on average seven or eight channels, and Cisco’s products now support six: telephone, email, Web, chat, social video and mobile. The analyst day showed a focus on video, and the presenters demonstrated innovative use of video to provide customer support, which although it is still in the early days of adoption (29% of companies currently support video), I expect this percentage to climb, partly as more consumers use Skype video calls for personal conversations and customer service. There also were demonstrations of innovative support for kiosks as a communication channel, including video. These, and mobility in particular, demonstrated more choice and improved experiences for customers. A key factor is that Cisco’s products are based on the same platform and so helps users provide their own customers with omnichannel experiences across the supported channels. Cisco Hosted Collaboration Solution for Contact Center is a version of Contact Center Enterprise packaged with the Cisco Unified Customer Voice Portal – Cisco’s version of IVR – and available through cloud computing. It provides services for companies wanting a large variety of capabilities and is scalable up to 12,000 seats. The services are available directly from Cisco through a public cloud or through Cisco-approved partners using their own cloud services. This option gives potential customers a wider choice but does create possible confusion as Cisco’s direct sales people are also compensated for selling partner services. Nevertheless it demonstrates the overall market disposition to use cloud services; its 19 approved partners delivered year-on-year growth of 182 percent during 2014, and 25 percent of Cisco’s contact center business now comes from cloud services. During a presentation one of its partners,

Cisco Hosted Collaboration Solution for Contact Center is a version of Contact Center Enterprise packaged with the Cisco Unified Customer Voice Portal – Cisco’s version of IVR – and available through cloud computing. It provides services for companies wanting a large variety of capabilities and is scalable up to 12,000 seats. The services are available directly from Cisco through a public cloud or through Cisco-approved partners using their own cloud services. This option gives potential customers a wider choice but does create possible confusion as Cisco’s direct sales people are also compensated for selling partner services. Nevertheless it demonstrates the overall market disposition to use cloud services; its 19 approved partners delivered year-on-year growth of 182 percent during 2014, and 25 percent of Cisco’s contact center business now comes from cloud services. During a presentation one of its partners,